US Federal Reserve decided to cut interest rates by 50 bps to 5% today. Here is the Jerome Powell press conference highlights:

- Fed confidence about still favorable labor market conditions and falling inflation is growing. However, inflation has eased notably, but remains above our goal.

- Unemployment risen but is still at low, historical levels; labor market is not pressure inflation as for now

- The Fed can maintain labor strength with policy adjustment, while consumer spending has remained resilient.

- Our decision today reflects growing confidence that strength in the labor market can be maintained.

- The economy is strong overall and inflation expectations are well anchored (at low levels) according to Fed sources and household surveys

- Downside risk for labor market risen, so Fed needs to balance it by rate cut accordingly; cutting rates too slowly may be more risky for US economy

- The labor market not a source of elevated inflationary pressures and continued to cool, which has been a notable step down from earlier this year. The labor market has cooled from a formerly overheated state.

- Fed projections show we expect GDP growth to remain solid. The bank will decide on rates meeting by meeting

"Our projections indicate that we don't need to be in a hurry" (dovish overtones that may suggest that the Fed is confident of a soft landing). Powell added also that 'No one should look at today and think that is a normal pace'. However, Fed chair commented that the US labor market is in solid condition now and the Fed wants to 'keep it there', which may be interpreted as a signal, that Wall Street can 'count' on Fed monetary easing if needed.

Start investing today or test a free demo

Open real account TRY DEMO Download mobile app Download mobile app- Indicators suggest that the labor market is less tight now than just before the pandemic

- The risk of rising inflation is diminishing, while the risk of a decline in the labor market is increasing.

- We don't need to see further loosening of labor market to get inflation down to 2% target

- There was broad support for a 50 bps cut today. There was a good discussion.

- Now we can go quicker or slower, or pause, on rate cuts if it is appropriate. Fed projections are a baseline projection; actual things we do depend on how the economy evolves. If the labor market deteriorates, we can respond.

- If the economy remains solid and inflation persists, we can dial back policy more slowly.

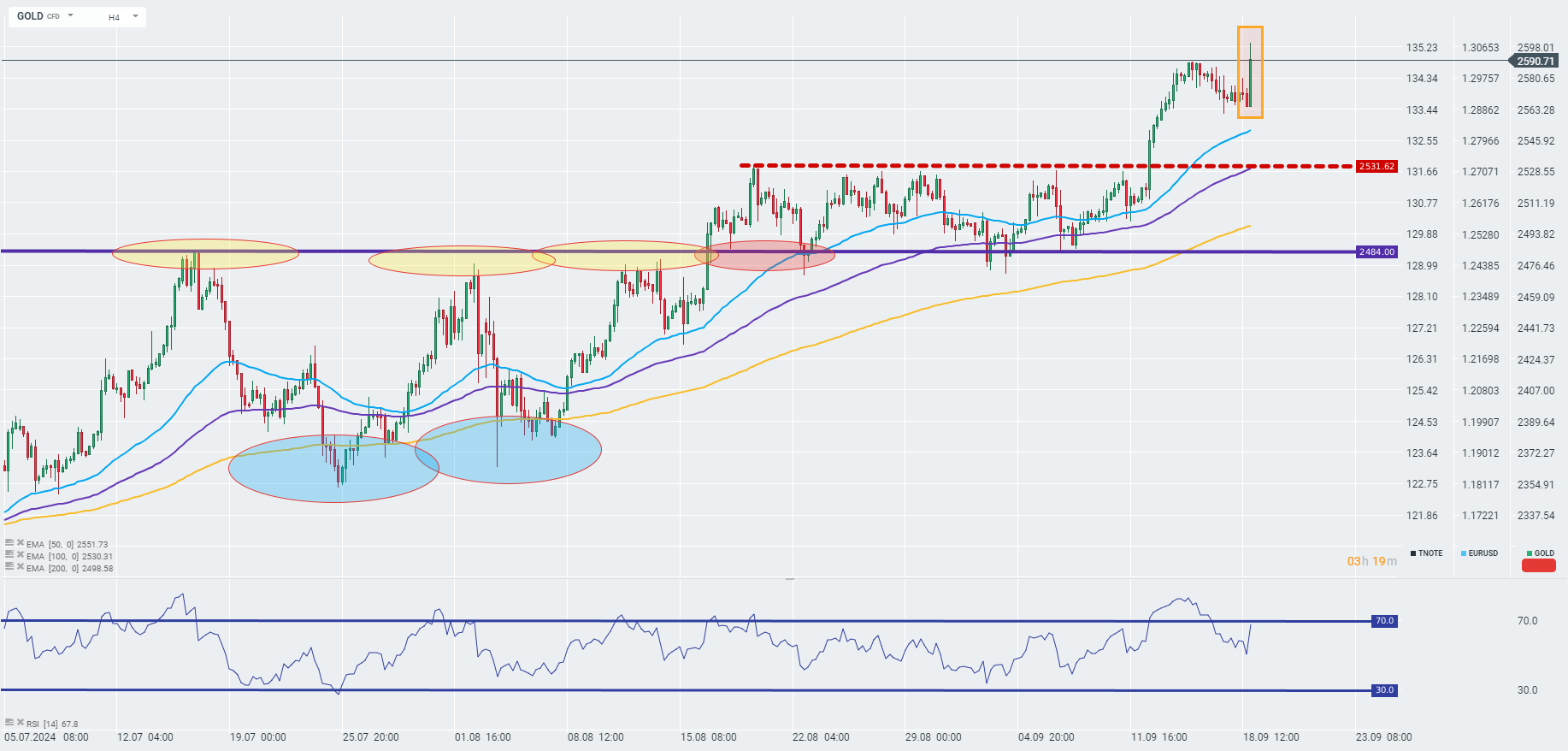

Powell maintains a dovish stance and suggests that a soft landing in the economy after the rate hike cycle will be maintained. The EURUSD pair extends gains slightly, however, the US100 halts some of the early upward momentum. Gold breaks out to new historic highs and tests the $2,600 per ounce level.

Source: xStaion5

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.