- The US100 is trading down -2.6%, buoyed by the ongoing sell-off in the semiconductor sector, with Intel losing -30% and Nvidia close to -4.5%

- The US30 and US100 are losing -1% and -1.3%, respectively, with the US2000 futures falling off more than -4%, following the Russell 2000's smaller-cap stocks

- Weak NFP data adds to concerns about a potential recession in the U.S. and the Fed's overly restrictive policies that are beginning to affect the economy, raising the jobless rate to 4.3% in July from 4.1% in June

- Betting on rate cuts is increasing; the market is pricing in a 90% chance of a 50bp cut in September and a total of more than 110bp of easing throughout 2024

- DoJ launches investigation targeting Nvidia's dominance, in AI chip market; Microchip and Snap shares record -15% and -22% sell-off, respectively

- Apple gains little and adds more than 2% after better-than-forecast results

In a wave of very weak U.S. non-farm employment readings, yields on 10-year U.S. bonds slid more than 12 basis points today, to 3.85%. The market is retreating from technology stocks, spooked by the mixed picture of the ongoing earnings season, during which macro data is increasingly disappointing. After yesterday's weak ISM, today's NFP report was severely disappointing, showing the lowest change in employment since 2021 and a 4.3% unemployment rate, despite an expected no change from June.

Additional uncertainty in the market is brought by a weak report from Amazon, a sizable part of whose business is its e-commerce operations, which are linked to the condition of American consumers. It is followed by the company's stock losing 10% today, and weak results and disappointing forecasts from Intel, which intends to lay off 15,000 employees and restructure its business operations; the stock lost nearly 30%.

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appThe U.S. Department of Justice has opened an investigation against Nvidia, causing the chip giant's shares to deepen yesterday's 6.6% decline by another nearly 4.5%, testing the 100-session simple moving average. Downward pressure is also evident in other cyclical semiconductor companies, from which the premium in valuations is gradually 'evaporating', along with lower valued chances of a soft landing of the economy.

Technology companies are the weakest components of US benchmarks today. The pharmaceutical sector is doing much better. Source: xStation5

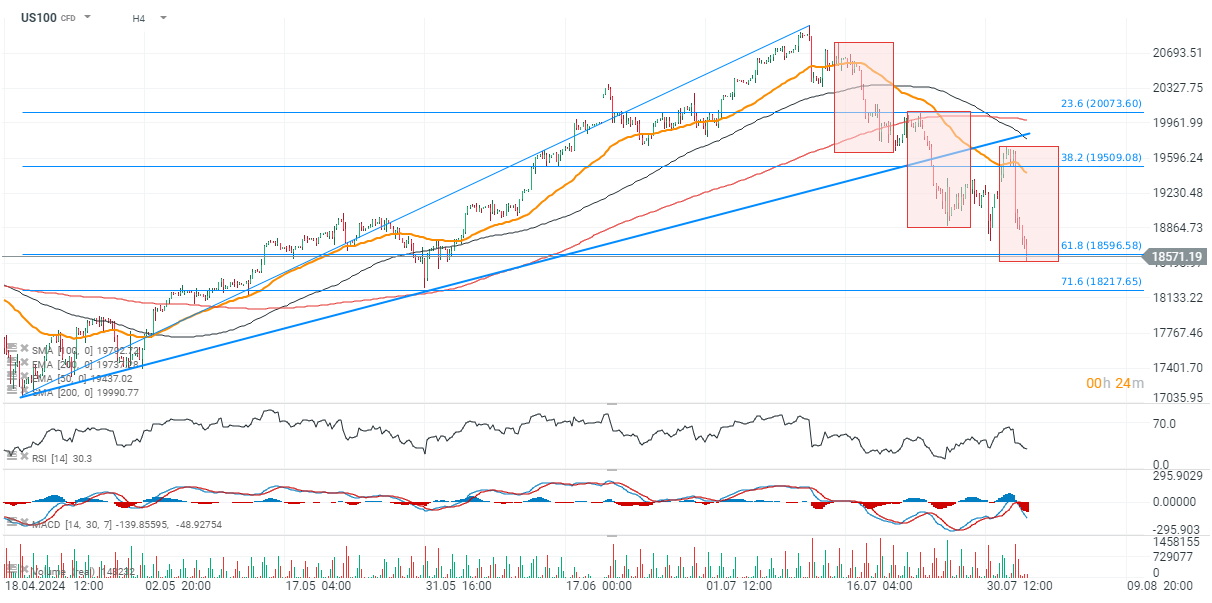

US100 (H4 interval)

![]()

Nasdaq 100 (US100) futures are trading near 1.5% declines, spurred by a sell-off in the chip sector and BigTech companies.

Source: xStation5

News from companies

-

Shares of Ardelyx (ARDX.US) are gaining 6%, as the company reported total revenues for the second quarter that exceeded analysts' average estimates. Shares of Block (SQ.US) are trading up slightly as the company raised its estimated adjusted Ebitda forecast for the full year, beating Wall Street forecasts

- Shares of Coinbase (COIN. US) are gaining slightly, close to 1%, following a Q2 report in which the cryptocurrency trading platform reported revenues that exceeded estimates. Jefferies highlighted the strength of subscription and services revenue, while Canaccord Genuity highlighted the company's diversifying revenue base.

- Cloudflare (NET.US) shares gained 2% after the cyber-security company's earnings and forecasts exceeded expectations, prompting price hikes from many investment bureaus. Brokers pointed to strong performance and high levels of management in a difficult environment. Some noted that the company could benefit from generative artificial intelligence.

- Lexicon Pharma (LXRX.US) shares are losing 15%. The company reported a second quarter loss of $0.17 per share. Microchip Technology (MCHP.US) is also losing, with its shares retreating 8%, after BofA downgraded the chipmaker to neutral from buy following its results. The bank pointed to uncertain catalysts leading to a short-term recovery.

- Snap (SNAP.US) shares lost nearly 22% after the technology and social media company's revenue fell below forecasts, and forecasts for the third quarter. Analysts pointed to the company's highly volatile business model; consumer spending fel

- Twilio (TWLO.US) shares gain nearly 5% after the software company reported second-quarter results that beat expectations

Amazon's business is growing ... But shares are falling

The market is betting that investors have 'caved' on Amazon's valuation, given the uncertainty in the U.S. economy, a rise in unemployment to 4.3% and declining wage pressure.

-

The company itself said that its Q3 2024 guidance, while optimistic, could change significantly as the economy worsens on a macro level. AWS sales grew 19% y/y, which the market ultimately perceived as quite disappointing (17% y/y was expected), looking at the sales momentum of Microsoft Azure and Google Cloud (about 30% y/y growth).

- Q2 sales amounted to $148 billion, but turned out to be $760 million below forecasts, and grew by 10.2% globally.... Though 'only' up 9% y/y in the US. Earnings per share ($1.26), on the other hand, exceeded expectations slightly, showing a nearly 90% increase over $0.65 in Q2 2023.

Amazon shares (D1 interval)

Amazon shares are retreating below the SMA200 (red line) for the first time since January 2021, and are recording a nearly 30% correction from historical highs. The company's shares are almost completely giving back this year's gains and are now one of the worst performing major U.S. technology companies. After breaking below the 23.6 Fibonacci retracement of the upward wave from the beginning of 2023, the first support can be looked for around the 38.2 Fibo near $155.

Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.