Trading has become the cornerstone of the development of modern civilization. Thanks to new technologies, investors can observe the daily changing quotes of thousands of listed companies, commodities, raw materials, currencies and digital assets. Millions of traders around the world engage in competitive rivalry through trading every day, with supply constantly reducing demand resulting in final valuations. Trading involves the taming and control of fear and greed, two emotions that powerfully influence the behaviour of supply and demand and determine bull market and bull market cycles.

In today's article we will focus on the basics of trading and try to describe the process and the basic principles that should guide a trader.

What is Trading?

As a rule, we can define trading as taking the action of buying or selling, that is, trading in selected assets in order to make a profit. The foundation of trading is the skillful prediction of the future behaviour of the price of the selected instrument (speculation). When traders predict correctly, the transaction is profitable, when the market behaves opposite to the direction of the transaction - they record a loss. It is accepted that trading is active trading (short or medium-term), as opposed to investing, which is often driven by other motivations and a longer investment horizon. In order to forecast the future correctly and with greater efficiency, traders focus on increasing their resources of knowledge, experience and techniques (technical analysis, fundamental analysis, etc.), as well as psychology which is the foundation of the market.

Speculation can take place both on leveraged instruments like OIL, US500 or Bitcoin as well as ordinary stock market shares because the essential foundation of trading is to correctly predict the future of assets. There are traders who trade only on selected instruments exploring the essence and behaviour of prices only within one or a few sectors. Others, on the other hand, trade everything, and their key reference point is exclusively the behaviour of the price overlaid with psychology and external factors (macroeconomics, monetary policy, cyclicality, etc.). Trading has no limitations, and traders are free to choose what they trade.

Two different market directions

![3 piles of coins and âsellâ âbuyâ dices]()

Traders can choose between trading directions. If they think prices will fall they open a so-called short-sale (short) transaction, which allows them to make a profit when valuations head south. On the other hand, when traders expect prices to rise, they open a buy (long) transaction, in which case they profit when prices rise.

Taking a short position is only possible on leveraged CFDs. On unleveraged stocks and ETFs, entitled to dividends and voting participation, investors can only buy or sell (close the open position), betting on declines is not possible.

To illustrate the operation of a long BUY (long) and short SELL (short) position:

Thomas opened a long (BUY) position (trade) on the CFDs Bitcoin instrument at $19,500. In 3 hours, the price of Bitcoin rose to $20,300. In this situation, Thomas will record a profit.

Thomas opened a short (SELL) position (trade) on the CFDs Bitcoin instrument at a price of $19,500. In 3 hours, the price of Bitcoin fell to $18,900. In this situation, Thomas will record a profit.

Thomas opened a long (BUY) position (trade) on the CFDs Bitcoin instrument at a price of $19,500. In 3 hours, the price of Bitcoin fell to SD 19,100. In this situation, Thomas will record a loss.

Thomas opened a short (SELL) position (trade), on the CFDs Bitcoin instrument at a price of $19,500. In 3 hours, the price of Bitcoin rose to $19,800. In this situation, Thomas will record a loss.

Trading or investing?

![âCFDsâ and âstocksâ wooden dices]() Although both active trading and investing are forms of trading, in principle, we can list a few fundamental differences between them:

Although both active trading and investing are forms of trading, in principle, we can list a few fundamental differences between them:

![Difference between traders and investors comparison table]()

Putting these two types of capital investments together, we can come to the conclusion that they are not mutually exclusive, since anyone can simultaneously build a portfolio consisting of investments with a long-term horizon as well as actively speculate on prices in the short term.

For example XTB Clients can invest in companies like Microsoft, Apple or Tesla, which does not exclude the fact that at the same time they can speculate on Bitcoin, gold or oil prices. In fact, both types of trading have their individual risks. Thus, for a shareholder who intends to hold shares of company X for the rest of his life, the risks are different than for someone who intends to keep open positions on oil for 2 or 5 days. In addition, each industry has its own individual specifications and factors that shape the price of specific assets affecting supply and demand.

Let's use examples:

Apple - It could be the success of a new product (new iPhone, VR headset), successful financial results, shareholder changes, problems with semiconductors.

Oil - OPEC+ activity, inventory reports (DoE, API) global economic conditions.

Bitcoin - Total Bitcoin available on the market (halvings).

NASDAQ (US100) - Institutional activity, market risk sentiment, Fed monetary policy.

EURUSD - Strength of the economy (GDP), trade balance, policy and decisions of central banks (Fed and ECB), consumer sentiment, ISM indexes, PMI, etc.

Investment tools selection

Of course, investors are more likely to use stock offerings and ETFs, which can be kept open indefinitely. Depending on the choice of ETF or exchange-traded company, investors can receive dividends and acquire the right to participate in shareholder meetings and votes. Stocks and ETFs are suitable for holding positions long term due to the lack of costs of holding positions and the structure and specification of these instruments.

Of the thousands of stocks and ETFs funds, the most popular are index funds like the iShares Core S&P500 UCITS ETF (CSPX.UK) or ETFs that give exposure to precious metals like the iShares Physical Gold ETC (IGLN.UK). Out of hundreds of ETFs, you can also find industry ETFs that offer exposure to a specific, selected sector such as emerging markets, the blockchain sector or automakers.

Traders are more likely to speculate on leveraged index futures (US100, US500, DE30), oil futures (OIL, OIL.WTI) or cryptocurrencies. Precious metals gold and silver are also popular, as well as other commodities and raw materials like natural gas, sugar and wheat. XTB also offers leveraged CFD stocks, which gives traders the opportunity to use leverage when speculating on hundreds of stocks of listed companies like Amazon, Microsoft or Bayer. Due to the access to leverage and the cost of holding positions (swap points), these instruments are rather suitable for short-term investments.

You can read more about CFDs here.

5 fundamentals of a trader

![âTradingâ key]()

Risk management

Risk is a key intrinsic to trading. Skillful risk mitigation avoids losses and gives the trader a chance to preserve profits. It is impossible to be right all the time, and the market will sooner or later show you that you are wrong. The key is, what will you do then? Trading is addressed to those who are aware of the huge risk of capital loss that is inherent in speculation and the market. At XTB, we know what the risk stakes are, which is why we provide clients with dozens of analytical tools in the xStation 5 platform, from technical analysis tools to news and market analysis, and allow the use of defensive orders such as stop loss, take profit and trailing stop loss. Basic elements of risk management include cutting losses before they start to grow and skillfully closing profitable positions.

You can read more about defensive orders here.

Gaining knowledge

Knowledge is the oxygen of every trader. It is not limited to studying the market starting with technical or fundamental analysis, but also to learning the nature and specifications of the instruments he intends to trade.

The study of psychology

Psychology is what the valuations of all assets are based on, according to the perception of incoming information or market beliefs about the future that instrument prices are formed. The market is a demanding place. Sometimes it happens that good information causes declines, and negative information turns out to be a catalyst for increases. To understand how the stock market pendulum works, one should study human psychology and read it in the context of information noise.

Determination

Determination has many faces, in the case of trading it can mean studying price charts, observing the market, gaining knowledge. Without passion and commitment, it's hard to get an edge in a place where everyone wants to succeed and make money. Remember that you are playing with a 'live opponent', and on the other side of the trade sit humans or algorithms built by humans.

Emotions under control

The foundation of trading is to control emotions and acquire an instrumental approach to money. Being afraid of losses is hard to achieve success. That's why it's so important to strip decisions of their emotional tinge and keep a cool head, making decisions in accordance with the strategy. Trading involves risk, but if emotions are involved the risk of losses increases. That is why it is so important to take care of your own mind and confidence level.

5 most popular instruments

Below we list five examples of financial instruments that are popular among traders and attract an avalanche of speculation:

S&P500 (US500) - The world's largest stock market index, which consists of the stock prices of the 500 largest listed businesses in the United States. The index used to be used as one of the key measurements of the health of the global and US economic conditions. The algorithm selects the companies included in the index,and its composition changes.

NASDAQ (US100) - A stock market index, which gained particular popularity during the 'dot-com' boom of the beginning of the new millennium (the year 2000). The index lists 100 companies, a significant number of which operate in the technology industry, which makes its volatility usually higher than the S&P500 index.

OIL - Oil is still one of the world's primary resources used mainly in transportation. It can be said that oil is still the lungs of the world’s economy. The instrument has attracted speculators for decades, and its susceptibility to OPEC+ decisions and external factors shaping oil prices makes it a popular tool among both derivatives and investment products (ETFs and oil stocks).

EURUSD - The world's most popular currency pair, which is one measure of the relative strength of the U.S. and European economies (the Eurozone).

Bitcoin - As a showcase of blockchain technology and the entire cryptocurrency sector, Bitcoin is attracting the attention of speculators and investors. Thanks to the record returns that cryptocurrencies have provided since their inception after 2010, the market is following their quotes with bated breath. Bitcoin has also lived to see its competition growing in strength, with Ethereum trying to catch up for many years.

The xStation5 platform offers access to more than 5000 of instruments including stocks, ETFs and CFD contracts on commodities, resources, cryptocurrencies, precious metals and leveraged ETF/stock shares. Please note each branch is subject to regulations and may not offer access to all instuments.

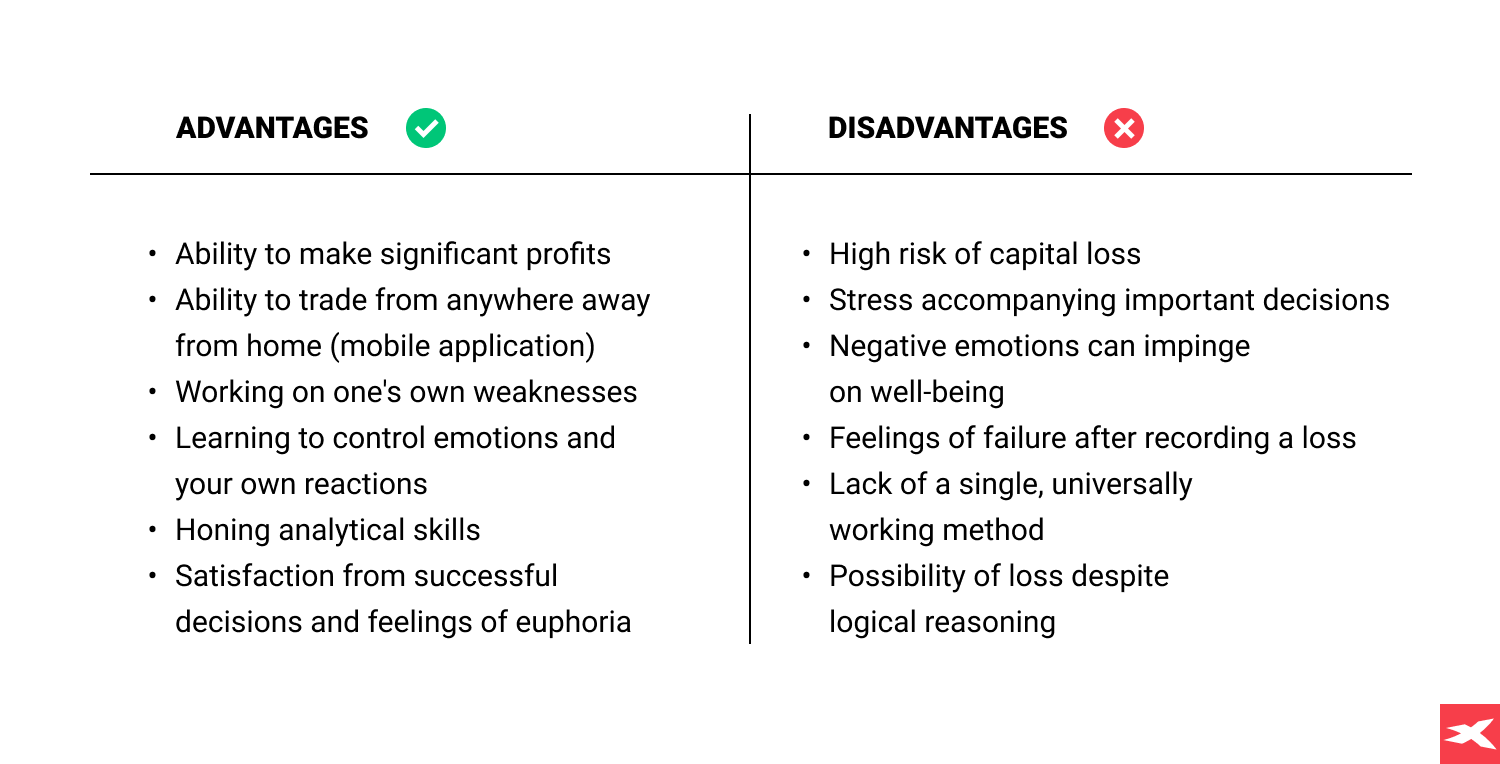

Trading - advantages and disadvantages

Trading has its advantages and disadvantages, which we want to present. Some of the advantages are made possible by access to the trading platform in the xStation mobile application. Below we list the most important ones.

![Advantages and disadvantages of trading comparison table]()

Risks and defensive actions

![âstop lossâ âtake profitâ âsell stopâ âsell limitâ dices and wooden house.]()

We would like to conclude this short article with this section to emphasise how important it is to limit and identify the risks that flow from trading. Below we will list the tools and actions that can be used in a process whose goal is to reduce it to the minimum possible:

- Using automatic defensive orders in CFD trading (Stop Loss, Take Profit, Rolling Stop Loss).

- Using automatic pending sell orders when trading stocks and ETFs (Sell Stop, Sell Limit)

You can read more about it here.

As a Trader, you will be making decisions that should be based on strategy to be repeatable and their effectiveness measurable:

- Develop some basic rules that you do not break

- Stick to the set rules and strategy if you have one

- Learn to control your emotions even in the face of a loss or limited profit

- Keep notes and analyse your decisions

- Learn by monitoring your own mistakes and accurate decisions

- Accept and control greed and fear

Indirectly reducing the risk of loss may also be among the actions. Gaining knowledge can significantly increase your 'healthy' confidence and make trading more effective:

- Studying technical and fundamental analysis

- Gaining knowledge about the assets you are speculating on

- Identifying the most important market information

- Activating the cause-and-effect process and transferring it to the market scenario

The xStation5 platform helps you at every stage of this process by providing, among other things:

- Access to analytical materials and market news (Research)

- Technical and fundamental analysis tools

- Advanced charting tools

- Calendar of economic and stock market events

- Open Customer Service 24 hours a day, 5 days a week

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.

Although both active trading and investing are forms of trading, in principle, we can list a few fundamental differences between them:

Although both active trading and investing are forms of trading, in principle, we can list a few fundamental differences between them: