What are the top concerns for British voters ahead of July 4?

The economy, healthcare, immigration, housing, and the environment are among the top concerns for British voters, according to a survey by YouGov. The economy and healthcare are the most pressing issues, with 52% and 50% of respondents citing them as key concerns, respectively.

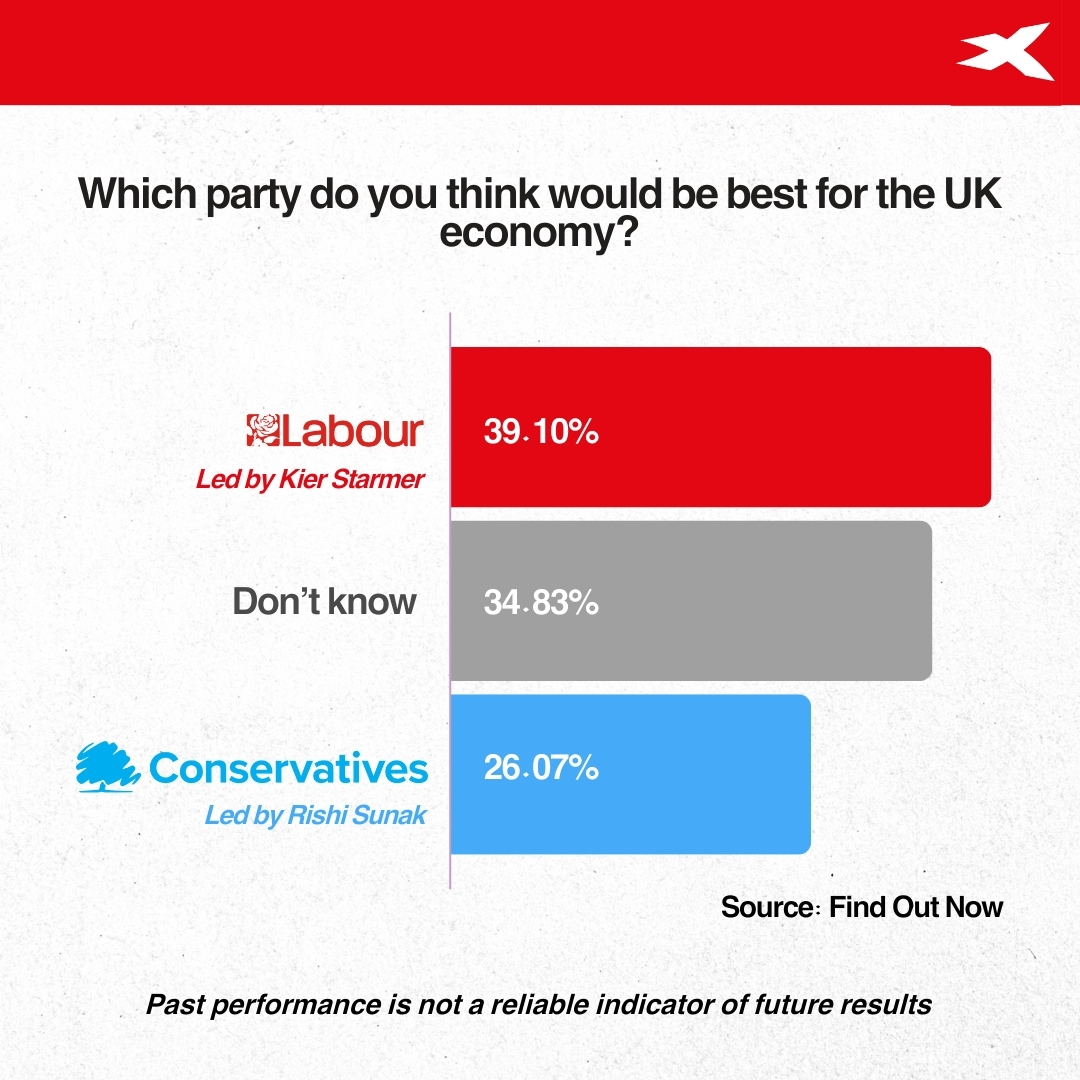

In a significant blow to the Conservative Party's economic messaging, a new poll created by XTB has found that Labour is more trusted than the Tories on the economy, business and the stock market. The detailed survey of over 1,000 stock market investors revealed that Labour is leading the Conservatives by 13 percentage points when it comes to who voters think would be best for the UK economy.

Chart 1: Which party do you think would be best for the UK economy?

![]()

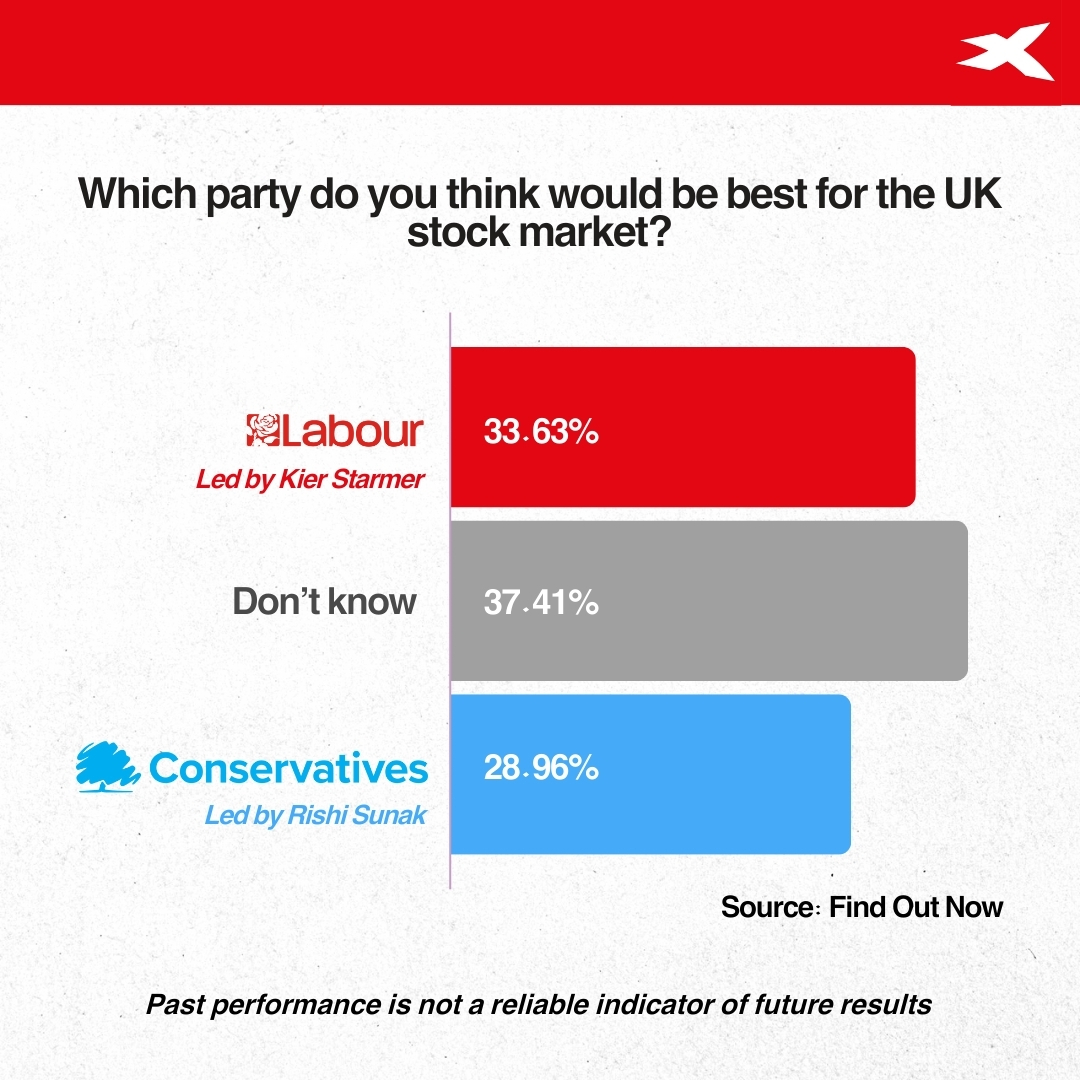

On the stock market specifically, Labour holds a 5-point lead.

Chart 2: Which party do you think would be best for the UK stock market?

![]()

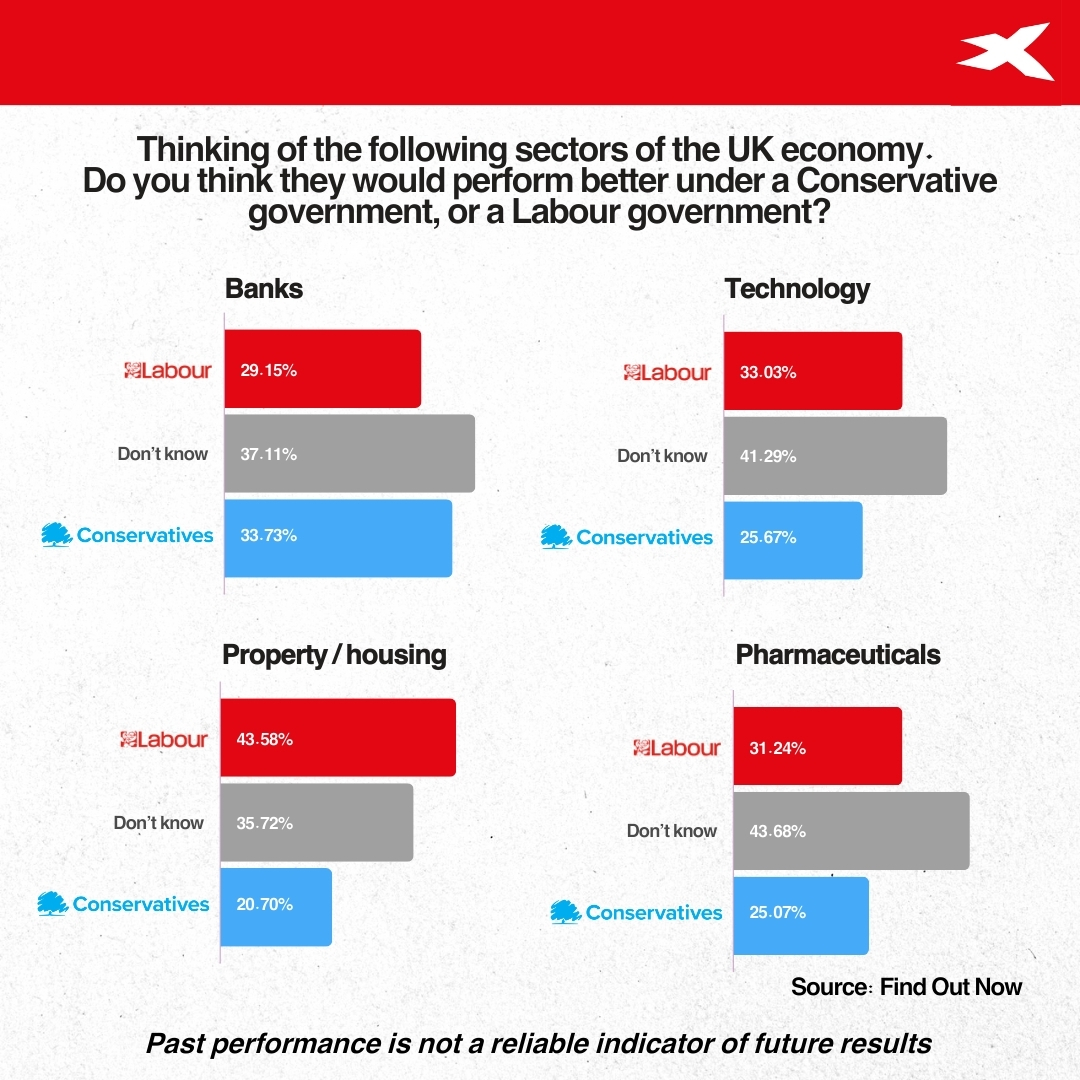

The results suggest that the Conservative attacks on Labour's economic policies have failed to resonate with investors. Across a range of key sectors, including housing, automotive, technology, pharmaceuticals and retail, voters believe these industries would perform better under a Labour government.

The only area where the Conservatives were seen as the better custodians was the banking sector.

Chart 3: Thinking of the following sectors of the UK economy. Do you think they would perform better under a Conservative government, or a Labour government?

![]()

XTB UK Managing Director Joshua Raymond said: “We were shocked by how strong the pro-Labour feeling is amongst investors," "While a lot of people remain undecided on some questions, the overwhelming view is that Labour would be a better custodian of the economy than the Tories."

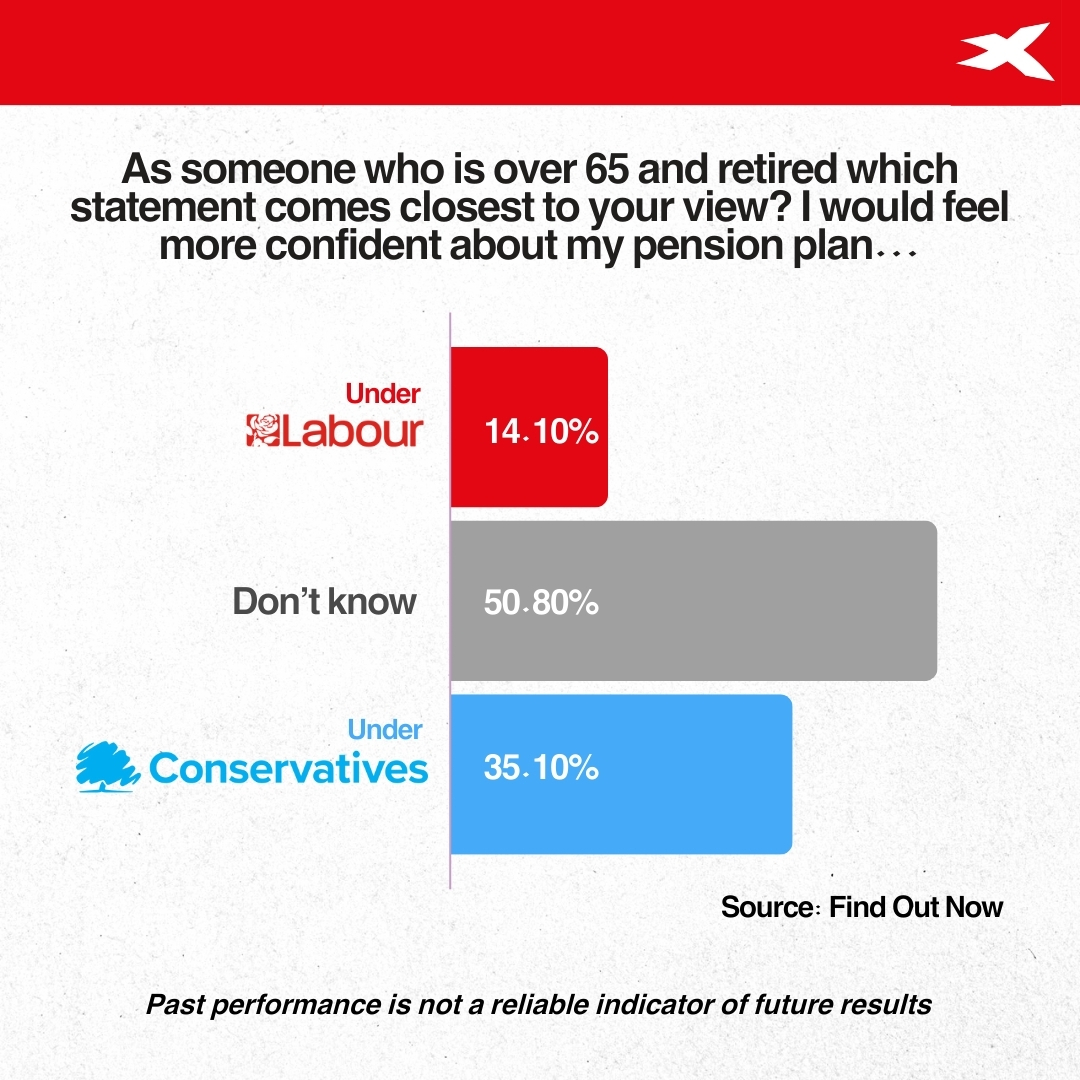

The poll also revealed interesting insights into voter attitudes towards pensions and taxation. While pensioners expressed more confidence in the Conservatives to manage their pensions, among the broader sample, Labour had a narrow lead.

Chart 4: As someone who is over 65 and retired, which statement comes closest to your view? I would feel more confident about my pension plan…

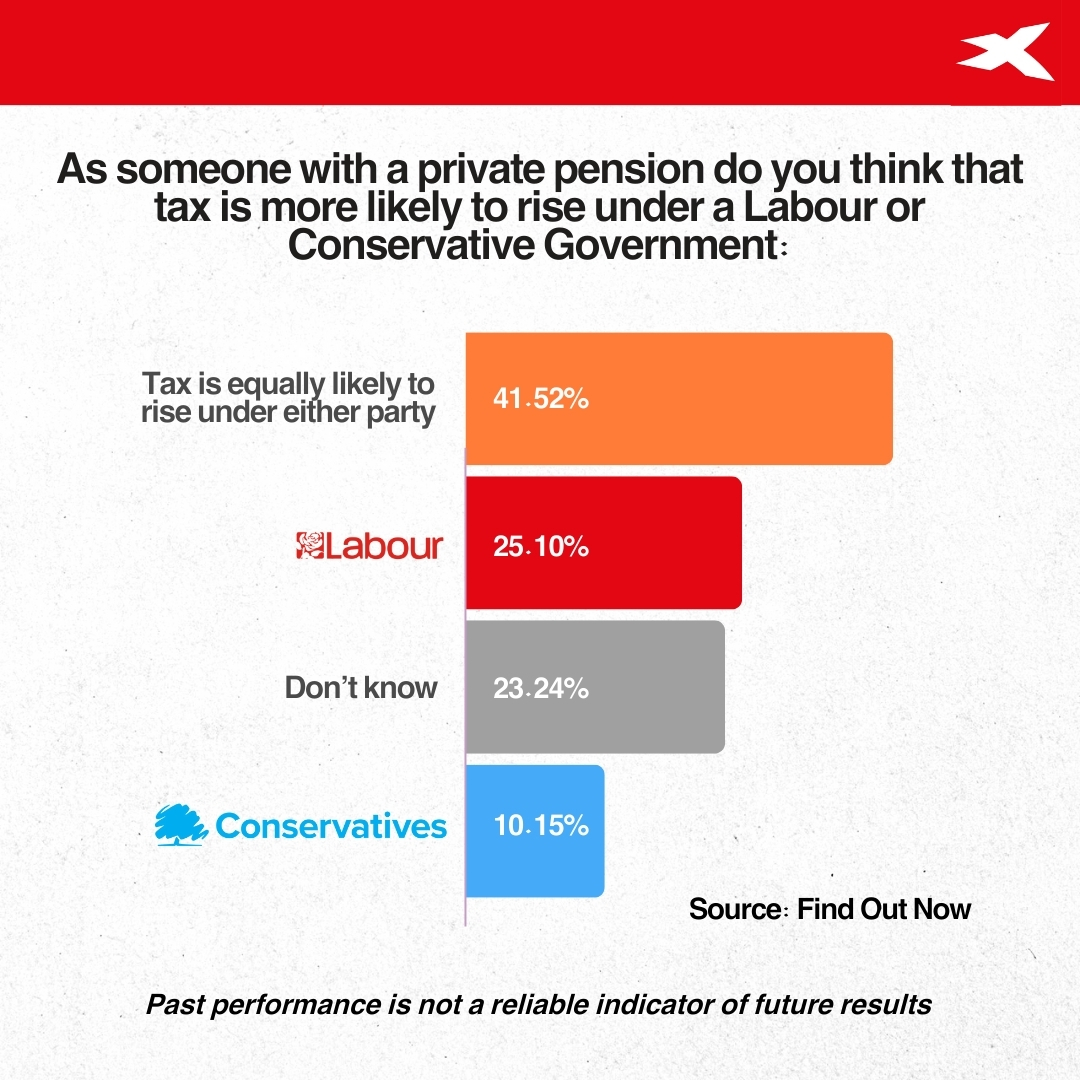

![]() On tax, both segments of the polling sample believed tax would be more likely to rise under a Labour government. However, a large proportion of voters said they expect taxes to rise regardless of which party is in power.

On tax, both segments of the polling sample believed tax would be more likely to rise under a Labour government. However, a large proportion of voters said they expect taxes to rise regardless of which party is in power.

Chart 5: As someone with a private pension do you think that tax is more likely to rise under a Labour or Conservative Government?

![]()

"It is clear that voters still trust the Conservatives more than Labour to control taxation," Raymond said. "However, what is also very apparent is that very few people trust either of the main parties when they say that taxes won't go up."

The findings of the XTB poll will be a significant cause for concern for the Conservative Party, as they suggest their economic messaging is failing to resonate with a key demographic - stock market investors. With the next general election looming, the Labour Party will be buoyed by these results, which indicate they are making inroads on the traditional Tory stronghold of economic competence.

Last debate key points

In their last televised debate before the general election, Prime Minister Rishi Sunak and Labour leader Keir Starmer engaged in a heated exchange over key issues like the economy, immigration, and political ethics. The debate, hosted by the BBC, saw Sunak repeatedly accuse Starmer of dishonesty regarding Labour's plans to reduce immigration, while Starmer criticised the Conservative leader for being "out of touch" due to his personal wealth.

Economic concerns were a major point of contention, with Starmer portraying Sunak as disconnected from the struggles of ordinary citizens. Sunak defended his party's economic record and warned voters not to "surrender" to Labour on issues like taxes.

The recent betting scandal involving Conservative and Labour politicians was also addressed, with both leaders promising to reform the political system. Starmer vowed to "reset politics" and restore public trust, while Sunak pledged to expel any Tory candidates who broke the rules.

Brexit rhetoric resurfaced during the discussion on border control, as Sunak urged voters not to relinquish control to Labour. The debate also touched on Labour's plans for decarbonising the economy and the potential costs involved. Recent polling data indicates a dramatic shift in parliamentary seat projections, with the Conservatives potentially retaining only 72 seats compared to Labour's 456, according to a Survation poll. This would surpass even Tony Blair's New Labour victory in 1997.

As the campaign enters its final week, both parties are intensifying their efforts to win over voters. Sunak is urging supporters to resist a Labour victory, while Starmer emphasises the opportunity for change after 14 years of Conservative rule.

Election impact on the stock market

Research Director Kathleen Brooks said: " Ahead of this Thursday’s election, the FTSE 100 has recorded a decent first half performance. It rose by 4.8% on a currency adjusted basis, lower than the 5% increase for the Eurstoxx 50 index, and well below gains for US indices, the S&P 500 rose by 14.5% in H1, the Nasdaq rose by a hefty 18%. While the FTSE 100 has long been a global underperformer vs. other developed markets, we will be watching the advancers/ decliners ratio, which has fallen in the past week, as there are signs of a growing number of declining stocks on the UK index. If this continues, then it may suggest some risk aversion for UK stocks in the lead up to this election.

A better gauge of a political risk premium for UK asset prices is the pound and the UK Gilt market. The pound is the best performer so far this year vs. the USD in the G10 FX space, although GBP/USD has fallen 0.6%. UK Gilt yields are also stable, the 10-year yield is higher by more than 60 basis points this year, however, the 10-year US Treasury yield is not far behind, rising more than 50 basis points so far in 2024. The French 10-year yield is higher by 73 bps YTD, which suggests that UK sovereign bond yields are not a global outlier caused by our upcoming election.

The UK’s FTSE 100’s performance was better than the French Cac 40. It fell 3.77% in H1, after a sharp fall for French banks in the past month. French banks are not the only domestic companies that are under pressure so far this year, Carrefour, Engie and Teleperformance are in the top ten worst performers in the Cac 40 in Q1."

Full Polling Results

Source: Polling was conducted by Find Out Now, surveying 1005 investors on 19 June 2024. Full polling results can be found at the following link: https://findoutnow.co.uk/blog/polling-for-xtb/

Asked about the general election on July 4:

Which party do you think would be best for the UK economy?

- Labour Party led by Keir Starmer 39.1%

- Don't know 34.83%

- Conservative Party led by Rishi Sunak 26.07%

Which party do you think would be best for the UK stock market?

- Don't know 37.41%

- Labour Party led by Keir Starmer 33.63%

- Conservative Party led by Rishi Sunak 28.96

Thinking of the following sectors of the UK economy. Do you think they would perform better under a Conservative government, or a Labour government?

Banks

- Don't know 37.11%

- Better under Conservative government 33.73%

- Better under Labour government 29.15%

Technology

- Don't know 41.29%

- Better under Labour government 33.03%

- Better under Conservative government 25.67%

Property / housing

- Better under Labour government 43.58%

- Don't know 35.72%

- Better under Conservative government 20.7%

Retail

- Don't know 40.9%

- Better under Labour government 39.3%

- Better under Conservative government 19.8%

Pharmaceuticals

- Don't know 43.68%

- Better under Labour government 31.24%

- Better under Conservative government 25.07%

As someone with a private pension, which statement comes closest to your view? I would feel more confident about my pension plan…

- Don't know 61.43%

- Under a Labour government 22.08%

- Under a Conservative government 16.5%

As someone with a private pension do you think that tax is more likely to rise under a Labour or Conservative Government:

- Tax is equally likely to rise under either party 41.52%

- Tax is more likely to rise under a Labour government 25.1%

- Don't know 23.24%

- Tax is more likely to rise under a Conservative government 10.15%

As someone who is over 65 and retired, which statement comes closest to your view? I would feel more confident about my pension plan…

- Don't know 50.8%

- Under a Conservative government 35.1%

- Under a Labour government 14.1%

As someone who is over 65 and retired do you think that tax is more likely to rise under a Labour or Conservative Government:

- Tax is more likely to rise under a Labour government 40.02%

- Tax is equally likely to rise under either party 36.71%

- Don’t know 14.57%

- Tax is more likely to rise under a Conservative government 8.7%

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.

On tax, both segments of the polling sample believed tax would be more likely to rise under a Labour government. However, a large proportion of voters said they expect taxes to rise regardless of which party is in power.

On tax, both segments of the polling sample believed tax would be more likely to rise under a Labour government. However, a large proportion of voters said they expect taxes to rise regardless of which party is in power.