Based on the comparison of return and performance, the best ETF for AI can be determined by analysing the data on AI ETFs. When looking for the best ETF for AI, consider the one with the strongest return and performance.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Do you agree that technology will transform the world in the following decades? If yes, one may consider investments in the technology sector. After generative intelligence entered the business world, financial markets tried to value this historic change. It’s powerful enough to completely change some companies' valuation and disrupt business models. It’s really hard to choose winners, without risking investing in losers, as technology is changing constantly. Choosing stocks related to AI for some investors may be too risky and bring additional risks. Professional and individual investors often use exchange traded funds.

Why? Those instruments give the opportunity to have well-balanced exposure to all technology, including the AI sector. This limits the potential of investing only in future winners, but it also limits the risk of investing in wrong companies, with inherent risks related to such investments. Navigating the growth of the artificial intelligence trend, our focused guide on ETFs which offer directly and indirectly exposure to AI. We will show pros and cons and try to identify key strategies for AI, focusing on Nasdaq100.

Key Takeaways

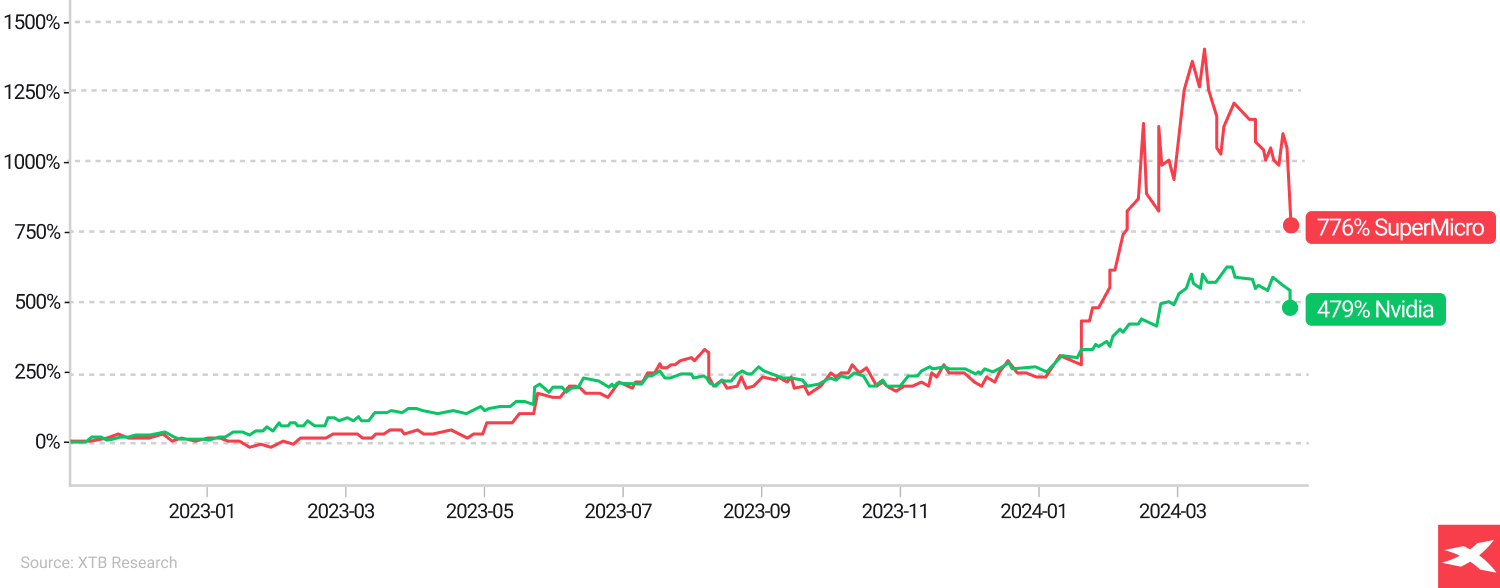

Since the GPT inception in the fall of 2022 to April 2024, AI-related stocks such as Nvidia (the biggest AI chips producer and technology provider) and Super Micro Computers (producer of server-racks for data centres) surged. However, volatility of these stocks is high, and concentration risk may be not accepted by some investors seeking diversification.

Since the GPT inception in the fall of 2022 to April 2024, AI-related stocks such as Nvidia (the biggest AI chips producer and technology provider) and Super Micro Computers (producer of server-racks for data centres) surged. However, volatility of these stocks is high, and concentration risk may be not accepted by some investors seeking diversification.

Past performance is not a reliable indicator of future results. Source: XTB Research, Bloomberg Finance LP

Functioning similarly to individual stocks, AI ETFs are investment funds that focus on companies involved in AI development. However, they offer an added advantage of diversification. Companies are chosen for inclusion in AI ETFs based on their involvement in AI-related activities. From AI chipmakers producing the necessary hardware to AI startups developing cutting-edge AI tools and technologies. Investing in an AI ETF is akin to buying a piece of the entire AI market, providing exposure to a wide array of stocks, which include both established and emerging players.

AI ETFs can be broadly categorised into two, basic types:

Thematic ETFs, on the other hand, are designed around specific industries, trends, or themes. They aim to capitalise on the growth of the AI market within the stock market. But as we mentioned it’s still hard to predict winners, and it’s also hard to predict which sector will grow “due to AI” revolution in the long run. Technology ETFs may be a much more conservative choice.

Factors like expense ratios, past performance, and diversification should be considered when evaluating AI ETFs. Here are some key factors to consider:

The art of diversification

Diversification, on the other hand, can help mitigate risk by spreading investments across various AI subgroups, asset classes, sectors, and geographic regions, thus reducing the risks associated with any individual investment. The underlying index, which dictates the performance and investment strategy of the ETF, is another significant aspect to understand.

Remember that diversification is not limited to just one ETF, as world-class investment manager Ray Dalio suggests that any investor should consider buying uncorrelated assets, which may limit overall portfolio risk. Investors may consider AI ETF exposure not only as a portfolio fundamental but also as a part of broader strategy but should know that imperfect diversification may not generate superior results and in general diversification usually mean lower investment returns.

ETFs that tackle the AI topic are:

These ETFs offer diversified exposure to a range of publicly traded companies involved in artificial intelligence stocks and related technologies, related with such sectors as:

All mentioned sectors above are in some way related to AI. Further AI development may change each of these industries. Some of the biggest technology companies such as Nvidia, Alphabet and Microsoft are present in almost all mentioned ETFs. The best source to learn more about any of the mentioned ETF is the official site, related to each one. Remember that “weights” of companies across each ETF portfolio may play a key role. The most popular one is iShares Nasdaq100 which gives investors exposure to 100 companies stocks from tech-heavy and world biggest US industries.

Like any other investment, AI ETFs also come with their share of risks. Primary risks include market volatility and regulatory changes that could impact the AI industry and, consequently, the performance of AI ETFs. AI-powered ETFs, however, have the ability to adjust their asset allocation to favour investments that are anticipated to perform well during periods of market volatility.

However, the potential benefits of investing in AI ETFs are significant, including diversification, adaptability to new market data, and the ability to leverage the growth of the AI sector. AI ETFs offer exposure to a broad range of AI companies, providing investors with the chance to benefit from the industry’s potential growth.

Let’s analyse pros and cons of AI ETF investing, for investors who accept that diversification usually lowers investment returns, but also limits inherent risks related to undiversified investment.

Pros

Cons

Several strategies can be contemplated by investors when incorporating AI ETFs into their investment portfolio. These include:

Risk tolerance is an important consideration when incorporating AI ETFs into an investment portfolio. Investors with a higher risk tolerance may find AI ETFs particularly appealing due to their potential for increased returns and suitable risk exposure. To achieve portfolio diversification across different asset classes, sectors, and regions, it is vital to maintain a balanced portfolio that includes AI ETFs along with other types of investments.

A common question among investors interested in the AI space is whether to opt for AI ETFs or individual AI stocks. AI ETFs offer investors the opportunity to gain exposure to a variety of AI stocks, thereby enabling diversification. In contrast, investing in individual AI stocks entails purchasing shares of particular companies engaged in AI development.

Investing in AI ETFs offers the following benefits:

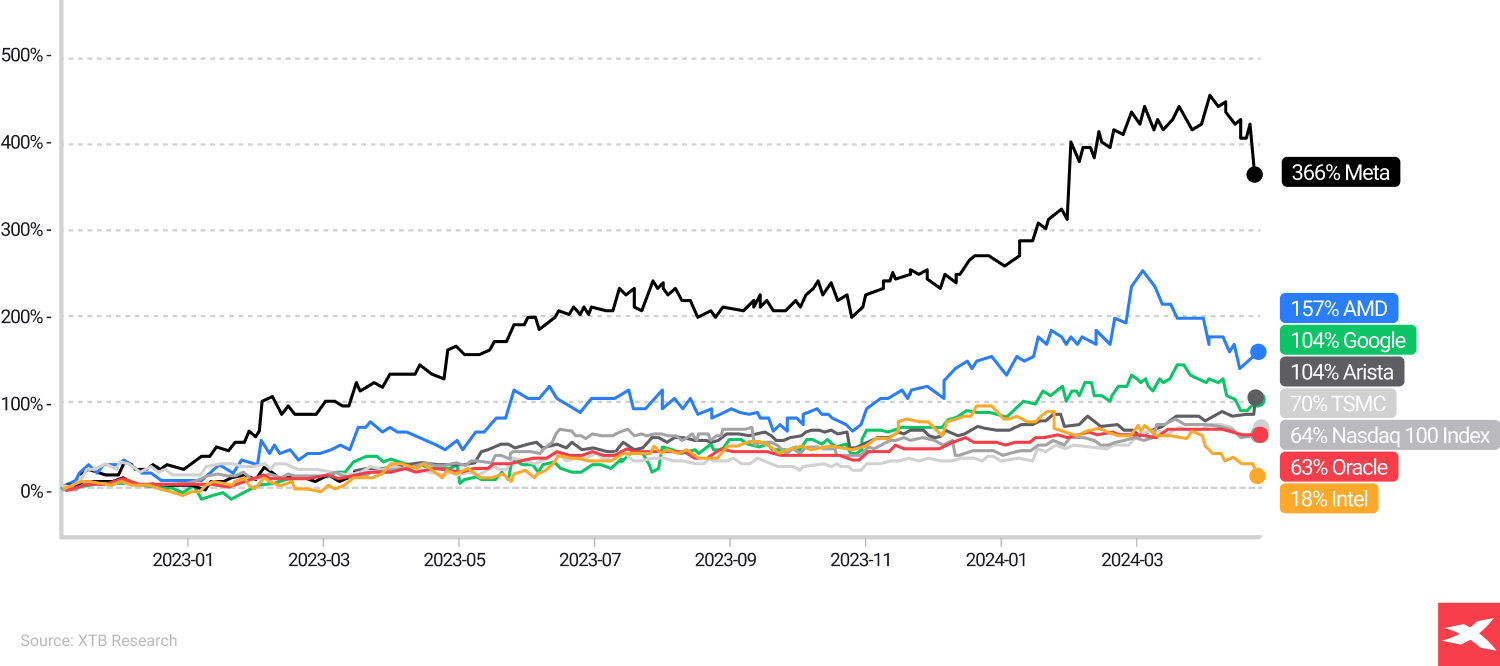

As we can see, since the fall of 2022 to April 2024 some of the biggest AI-related stocks (data centres, semiconductors, software, digital ads) outperformed Nasdaq 100 returns but Oracle and Intel underperformed tech-heavy US benchmarks.

Past performance does not guarantee future results. Source: XTB Research, Bloomberg Finance LP

As we look to the future, it is expected that AI will exert a significant influence on investment strategies. With the ability to drive economic expansion, enhance technological capacities, and revolutionise investment processes, AI presents numerous opportunities for investors. However, potential risks associated with investing in AI should also be considered. These include:

The inadvertent perpetuation or amplification of societal biases

The future advancement of AI could have an impact on the performance of AI ETFs by providing them with the capability to:

Furthermore, there has been notable performance variability among AI ETFs, with leading thematic strategies delivering impressive returns.

In conclusion, AI ETFs present an interesting investment opportunity for those looking to capitalise on the growth and potential of the AI industry. By understanding the different types of AI ETFs, investors will be able to choose the best tools to realise investment strategy. Evaluating key factors to consider when investing are understanding the risks and potential rewards.

Investors should look at investing costs and choose the right assets to achieve long term investment goals. Overall impact of AI on investing is expected to grow, but investors should also know that if valuations are very high, AI trends may be not enough to drive those even higher. A major risk for any AI ETF is possible economic slowdown. Investors should know well the importance of understanding and incorporating ETFs into investment portfolios.

Based on the comparison of return and performance, the best ETF for AI can be determined by analysing the data on AI ETFs. When looking for the best ETF for AI, consider the one with the strongest return and performance.

No, Vanguard does not have a dedicated artificial intelligence ETF. However, the Vanguard Information Technology ETF (VGT) includes some AI exposure.

It’s hard to identify the best AI opportunity to invest in. Investors should do their own research and accept the high risk of those investments. One can check AI companies, related to AI-trend such as NVIDIA Corporation (NVDA.US) and AMD (AMD.US) for its development of high-end GPUs and expansion into AI capabilities, alongside with Arista Networks (ANET.US) or SuperMicro Computer (SMCI.US) which can expand business due to higher CAPEX across data centres sector. Although, it is very important to do your own research.

To invest in AI stocks in the UK, open a brokerage account with an online platform offering AI-focused stocks and funds such as XTB. Diversify your investments and stay informed about AI industry trends to make informed decisions.

AI ETFs are investment funds that focus on companies involved in AI development, providing diversification and exposure to the growing AI industry.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.